In the ever-growing supply of business accounting software, choosing the right tool can significantly impact your financial management and overall business efficiency. With numerous options available, two names often rise to the top: QuickBooks and Xero. In this comprehensive review titled “Review: QuickBooks vs. Xero – Which is Better for Your Business?”, we will go into a head-to-head comparison of these two industry giants, helping you make an informed decision that could elevate your business to new heights.

Disclosure: If you click on my affiliate/advertiser’s links, I am going to receive a tiny commission. AND… Most of the time, you will receive an offer of some kind. It’ s a Win/Win!

Managing finances efficiently is crucial for the success of any business, regardless of its size. QuickBooks and Xero have emerged as leaders in the field, each offering unique features and benefits tailored to various business needs. As a business owner or financial manager, you must understand how each platform can serve your specific requirements. This article will provide a thorough analysis, comparing QuickBooks and Xero on multiple fronts, so you can choose the one that aligns best with your business goals.

Accounting software is more than just a tool; it’s an integral part of your business strategy. The right software can streamline your processes, reduce errors, and provide valuable insights into your financial health. QuickBooks and Xero both offer robust solutions, but they cater to slightly different audiences and use cases. Whether you’re a small business owner, a freelancer, or managing a large enterprise, understanding the nuances of each software will guide you to the best choice for your business.

QuickBooks, developed by Intuit, has been a staple in the accounting software market for decades. It offers a wide range of features from invoicing and payroll to inventory management and tax filing. Xero, on the other hand, is a newer entrant that has quickly gained a loyal following thanks to its cloud-based approach and user-friendly interface. Both platforms have their strengths and weaknesses, and this review will dissect these aspects to give you a clear picture.

As we go through this comparison, we will explore key areas such as pricing, features, user experience, customer support, and more. By the end of this article, you will have a comprehensive understanding of which platform suits your business needs better, ultimately helping you elevate your business acumen and improve your financial management skills.

Unlock Global Growth with Wise Business

Tired of high international transfer fees and complex currency conversions? Join Wise Business and revolutionize your global finances. Enjoy:

- Borderless Banking: Access multiple currencies in one account.

- Instant Transfers: Send and receive money worldwide at lightning speed.

- Low-Cost Currency Conversion: Save on foreign exchange fees.

- Smart Business Tools: Manage expenses, invoices, and more, all in one place.

Apply now by clicking HERE and receive your free card to supercharge your business’s global potential.

Table of Contents

1. Overview of QuickBooks and Xero

– Introduction to both software platforms, their history, and market position.

2. Pricing Comparison

– Detailed analysis of the pricing structures, including different plans and what they offer.

3. Ease of Use

– Evaluation of the user interfaces and the overall user experience of both QuickBooks and Xero.

4. Feature Comparison

– A side-by-side comparison of the key features offered by QuickBooks and Xero, including invoicing, payroll, and inventory management.

5. Integration Capabilities

– Discussion on how well each software integrates with other tools and platforms commonly used in business operations.

6. Mobile Accessibility

– Examination of the mobile apps provided by QuickBooks and Xero, and their functionalities.

7. Customer Support and Resources

– Overview of the customer support options and additional resources available to users of both platforms.

8. Scalability and Customisation

– Insights into how each platform scales with growing businesses and the customisation options available.

9. Security and Data Protection

– Analysis of the security measures implemented by QuickBooks and Xero to protect user data.

10. User Reviews and Testimonials

– Compilation of user reviews and testimonials to provide real-world insights into the experiences of QuickBooks and Xero users.

11. Side-by-Side Comparison of Key Features: QuickBooks vs Xero

12. Summary & Conclusion: Making the Right Choice for Your Business

1. Overview of QuickBooks and Xero

QuickBooks and Xero are two of the most prominent names in the accounting software industry. QuickBooks, developed by Intuit, has been a cornerstone in the market for decades, catering to businesses of all sizes with its extensive features and robust functionality. Xero, on the other hand, is a relatively newer player but has quickly gained popularity due to its cloud-based approach and intuitive user interface. Understanding the historical context and market position of these two platforms is essential for appreciating their strengths and how they might fit into your business.

QuickBooks offers a comprehensive suite of tools designed to manage everything from invoicing to payroll. It has evolved significantly over the years, adapting to the changing needs of businesses. Xero, with its modern, cloud-first approach, appeals to businesses looking for flexibility and ease of use. By comparing these platforms, you can determine which aligns best with your operational style and long-term goals.

Choosing the right accounting software is crucial. An inappropriate choice can lead to inefficiencies, increased costs, and even compliance issues. For instance, a large enterprise might struggle with a platform designed for small businesses due to scalability limitations. Conversely, a small business might find a feature-rich enterprise solution overly complex and expensive. Therefore, understanding the fundamental differences between QuickBooks and Xero helps in making an informed decision.

Both QuickBooks and Xero offer trial versions, allowing businesses to test their features before committing. This hands-on experience can provide valuable insights into how each platform works in practice, helping you assess their usability and fit for your business needs. Evaluating these software options carefully can lead to improved financial management and business efficiency.

2. Pricing Comparison

One of the most critical aspects of choosing between QuickBooks and Xero is understanding their pricing structures. Both platforms offer various plans designed to cater to different business sizes and needs. QuickBooks generally offers a range of plans from Simple Start to Advanced, each adding more features and capabilities as you move up the pricing tier. Xero’s pricing is similarly tiered, with plans such as Starter, Standard, and Premium.

QuickBooks’ pricing plans start at a lower price point, which can be attractive for small businesses and startups. However, as your needs grow, you may find yourself upgrading to more expensive plans to access advanced features. Xero’s plans are slightly more expensive on the lower end but offer comprehensive features even in their basic plan, making it a strong contender for businesses looking for a balanced offering right from the start.

Understanding the nuances of these pricing models is crucial. Overpaying for unnecessary features can strain your budget, while opting for a cheaper plan might leave you without essential tools. For instance, if your business requires robust inventory management, it’s important to choose a plan that includes this feature to avoid additional costs later.

Both QuickBooks and Xero occasionally offer discounts and promotions, which can be a great way to save money initially. However, it’s important to look beyond these offers and consider the long-term costs and benefits of each platform. A thorough analysis of pricing against your business needs ensures you choose a solution that offers the best value for money.

3. Ease of Use

When it comes to accounting software, ease of use is a significant factor. QuickBooks is renowned for its user-friendly interface and comprehensive tutorials, making it accessible even for those without extensive accounting knowledge. The dashboard is intuitive, allowing users to quickly navigate through various features like invoicing, expense tracking, and financial reporting.

Xero also prides itself on its user-friendly design. Its clean interface and straightforward navigation make it easy for users to manage their finances efficiently. Xero’s cloud-based nature means that updates and new features are seamlessly integrated, ensuring users always have access to the latest tools without needing to worry about manual upgrades.

Choosing a platform that is easy to use can save you time and reduce the likelihood of errors. For instance, an overly complex system might lead to mistakes in financial reporting, which can have serious implications for your business. Both QuickBooks and Xero offer extensive support resources, including tutorials, webinars, and customer support, to help users get the most out of their software.

However, the best way to determine ease of use is by trying the software yourself. Both QuickBooks and Xero offer trial periods, allowing you to explore their interfaces and features firsthand. This hands-on experience can be invaluable in understanding which platform feels more intuitive and better aligned with your workflow.

DELTA SALES APP. Sales Force Automation App for Your Field Employees. Designed for manufacturers, wholesalers and distributors to streamline their field sales activities and to accelerate sales. Get your FREE trial HERE.

4. Feature Comparison

A detailed feature comparison is essential to understand what QuickBooks and Xero can offer your business. QuickBooks provides a wide range of features, including advanced reporting, inventory management, and comprehensive payroll services. Its invoicing and expense tracking capabilities are particularly robust, making it a favourite among small to medium-sized businesses.

Xero, while also offering extensive features, stands out with its strong focus on cloud-based functionality and real-time data access. It excels in providing seamless bank reconciliation, multi-currency support, and excellent integration with third-party apps. Xero’s emphasis on automation helps reduce manual data entry, saving time and improving accuracy.

Understanding the specific features you need is crucial. For example, if your business involves significant inventory management, QuickBooks’ advanced inventory features might be more beneficial. On the other hand, if you require strong integration with other cloud-based tools, Xero’s extensive app marketplace could be a game-changer.

Both platforms offer mobile apps, enabling you to manage your finances on the go. QuickBooks and Xero continuously update their features to meet evolving business needs, so staying informed about these updates is important. A feature-rich accounting software that aligns with your business needs can enhance efficiency and provide valuable insights into your financial health.

5. Integration Capabilities

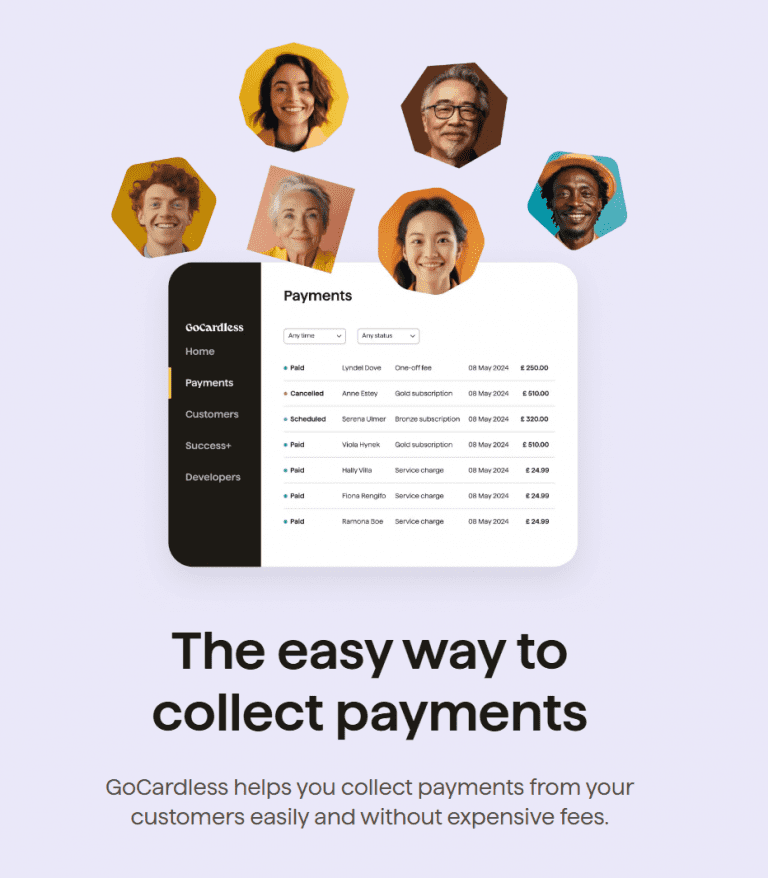

Integration capabilities are vital for any accounting software, as they determine how well the platform can connect with other tools and services you use in your business. QuickBooks integrates seamlessly with a wide range of third-party applications, including payment processors, CRM systems, and e-commerce platforms. This makes it easier to manage your entire business ecosystem from a single interface.

Xero is equally strong in this area, offering integrations with over 800 third-party apps. Its open API allows developers to create custom integrations, making it a flexible choice for businesses with unique needs. Xero’s integration with popular apps like Stripe, PayPal, and HubSpot can significantly enhance your operational efficiency and data accuracy.

Choosing accounting software with robust integration capabilities can streamline your workflows and reduce manual data entry. For instance, integrating your accounting software with your CRM system ensures that your financial data is always up-to-date and accurately reflects your business activities. This can save you time and reduce the risk of errors.

Both QuickBooks and Xero continuously expand their integration offerings, so it’s essential to review the latest integrations available. By selecting a platform that integrates well with your existing tools, you can create a cohesive and efficient business environment, enhancing overall productivity and decision-making.

The Frictionless Sales Engagement Platform for Revenue Teams. The world’s first all-in-one sales engagement platform that allows your sales team to engage more prospects and close more deals without software exhaustion.

Book a demo HERE

6. Mobile Accessibility

In today’s fast-paced business world, mobile accessibility is more important than ever. QuickBooks offers a robust mobile app that allows you to manage your finances on the go. With the QuickBooks app, you can create and send invoices, track expenses, and view real-time financial reports, all from your mobile device. This flexibility ensures that you can stay on top of your financial management, no matter where you are.

Xero’s mobile app is equally impressive, providing a comprehensive suite of features that mirror the desktop experience. The Xero app allows you to reconcile bank transactions, create and send invoices, and even manage payroll from your smartphone. Its intuitive design makes it easy to navigate, ensuring that you can manage your finances efficiently, even while away from the office.

Having access to your accounting software on mobile devices can be a game-changer for business owners and managers. It ensures that you are always in control of your finances, whether you’re travelling, attending meetings, or working remotely. This level of accessibility can lead to better financial management and quicker decision-making.

Both QuickBooks and Xero continue to enhance their mobile apps with new features and improvements. Staying updated with these advancements can help you take full advantage of mobile accessibility, ensuring that your financial management remains seamless and efficient.

7. Customer Support and Resources

Reliable customer support and access to comprehensive resources are crucial when choosing accounting software. QuickBooks offers extensive customer support options, including phone support, live chat, and an online community where users can ask questions and share knowledge. Additionally, QuickBooks provides a wealth of resources such as tutorials, webinars, and detailed guides to help users navigate the software effectively.

Xero is also known for its excellent customer support. It offers 24/7 online support, ensuring that users can get help whenever they need it. Xero’s support team is highly responsive, providing timely and helpful solutions to user queries. Moreover, Xero offers a rich library of resources, including how-to videos, articles, and a user community that fosters collaboration and knowledge sharing.

Choosing software with strong customer support can significantly enhance your user experience. It ensures that you can resolve issues quickly, minimizing downtime and maintaining productivity. Both QuickBooks and Xero’s support options and resources are designed to help users get the most out of their software, making it easier to manage your finances effectively.

Engaging with these resources can provide valuable insights and tips on using the software more efficiently. Whether you’re a beginner or an advanced user, taking advantage of customer support and educational resources can help you optimize your accounting processes and improve your overall financial management skills.

8. Scalability and Customisation

Scalability and customisation are critical factors for businesses looking to grow and adapt to changing needs. QuickBooks offers a range of plans that cater to different business sizes and needs. As your business grows, you can easily upgrade to a more advanced plan that offers additional features and capabilities. QuickBooks also allows for significant customisation, enabling you to tailor the software to your specific business requirements.

Xero is designed with scalability in mind, making it a popular choice for growing businesses. Its flexible pricing plans and extensive feature set ensure that it can accommodate businesses of various sizes and industries. Xero’s open API allows for custom integrations, providing the flexibility to create tailored solutions that meet your unique needs.

Choosing scalable and customisable accounting software ensures that it can grow with your business, avoiding the need for costly and disruptive transitions to new systems. For example, if your business expands internationally, having a platform that supports multi-currency transactions and global compliance is crucial. Both QuickBooks and Xero offer features that support scalability and customisation, ensuring that your accounting software remains a valuable asset as your business evolves.

Evaluating your long-term needs and understanding how each platform can scale and adapt to those needs is essential. This foresight can save you time and money, providing a stable foundation for your business’s financial management and growth.

9. Security and Data Protection

Security and data protection are paramount when it comes to accounting software. QuickBooks implements robust security measures to protect user data, including encryption, secure data centres, and regular security audits. It also offers features like multi-factor authentication and user permissions to enhance data security further.

Xero takes security very seriously, with bank-grade encryption and strict data protection protocols. Its security features include two-step authentication, role-based access, and regular security updates to ensure that user data is always protected. Xero also complies with global data protection regulations, providing peace of mind for businesses operating in multiple jurisdictions.

Understanding the security measures of your accounting software is crucial to protect sensitive financial information. A security breach can have severe consequences, including financial loss and damage to your business’s reputation. By choosing software with robust security features, you can mitigate these risks and ensure that your data remains safe.

Both QuickBooks and Xero are committed to maintaining the highest security standards, making them reliable choices for businesses concerned about data protection. Staying informed about the latest security updates and best practices can further enhance your data security, ensuring that your financial information is always safeguarded.

10. User Reviews and Testimonials

User reviews and testimonials provide valuable insights into the real-world performance of accounting software. QuickBooks has a large user base, with many positive reviews highlighting its comprehensive features and ease of use. Users appreciate its robust reporting capabilities and the convenience of managing finances through its mobile app. However, some reviews mention that the software can become expensive as additional features are required.

Xero also enjoys a strong reputation among users, particularly for its cloud-based functionality and user-friendly interface. Many users praise Xero for its seamless bank reconciliation and integration capabilities. Testimonials often highlight the software’s ability to save time through automation and its excellent customer support. Some users, however, note that it can take time to get accustomed to Xero’s interface if they are transitioning from another platform.

Reading user reviews and testimonials can help you understand the strengths and weaknesses of each platform from a user’s perspective. It provides a realistic view of what to expect and can help you identify any potential issues that might affect your business. Both QuickBooks and Xero have a wealth of user feedback available online, making it easier to gauge their performance and suitability for your needs.

Incorporating user experiences into your decision-making process ensures that you choose accounting software that meets your expectations and requirements. By learning from the experiences of others, you can make a more informed choice that enhances your financial management and supports your business’s growth.

The side-by-side comparison of key features offered by QuickBooks and Xero is now available for review. This table provides an easy-to-read format that compares the pricing plans, ease of use, invoicing capabilities, expense tracking features, payroll services, inventory management, bank reconciliation, multi-currency support, third-party integrations, mobile app functionality, customer support, scalability, customisation options, security, data protection, and user reviews for both QuickBooks and Xero.

Video testimonials that stop the scroll with zero tech fuss

Trust streamlines testimonials, saving time and money. Easily create video testimonials and integrate reviews on your website in minutes, no developer or hosting needed.

* 14-day trial, no credit card required. Click HERE.

11. Side-by-Side Comparison of Key Features: QuickBooks vs Xero

| Feature | QuickBooks | Xero |

|---|---|---|

| Pricing Plans | Simple Start, Essentials, Plus, Advanced | Starter, Standard, Premium |

| Ease of Use | User-friendly interface with comprehensive tutorials | Clean interface and straightforward navigation |

| Invoicing | Advanced invoicing capabilities | Comprehensive invoicing capabilities |

| Expense Tracking | Robust expense tracking features | Extensive expense tracking features |

| Payroll Services | Comprehensive payroll services | Effective payroll management |

| Inventory Management | Advanced inventory management | Strong inventory management features |

| Bank Reconciliation | Bank reconciliation available | Seamless bank reconciliation |

| Multi-Currency Support | Supports multi-currency transactions | Supports multi-currency transactions |

| Third-Party Integrations | Seamless integration with a wide range of apps | Integration with over 800 third-party apps |

| Mobile App | Robust mobile app with extensive features | Comprehensive mobile app with extensive functionalities |

| Customer Support | Phone support, live chat, online community | 24/7 online support, responsive team |

| Scalability | Scales with business growth | Designed for scalability |

| Customisation | Significant customisation options | Custom integrations via open API |

| Security | Encryption, secure data centres, multi-factor authentication | Bank-grade encryption, strict data protection protocols |

| Data Protection | Regular security audits and compliance | Compliance with global data protection regulations |

| User Reviews | Positive reviews highlighting features and ease of use | Positive reviews for cloud functionality and user interface |

A detailed feature comparison is essential to understand what QuickBooks and Xero can offer your business. QuickBooks provides a wide range of features, including advanced reporting, inventory management, and comprehensive payroll services. Its invoicing and expense tracking capabilities are particularly robust, making it a favourite among small to medium-sized businesses.

Xero, while also offering extensive features, stands out with its strong focus on cloud-based functionality and real-time data access. It excels in providing seamless bank reconciliation, multi-currency support, and excellent integration with third-party apps. Xero’s emphasis on automation helps reduce manual data entry, saving time and improving accuracy.

Understanding the specific features you need is crucial. For example, if your business involves significant inventory management, QuickBooks’ advanced inventory features might be more beneficial. On the other hand, if you require strong integration with other cloud-based tools, Xero’s extensive app marketplace could be a game-changer.

Both platforms offer mobile apps, enabling you to manage your finances on the go. QuickBooks and Xero continuously update their features to meet evolving business needs, so staying informed about these updates is important. A feature-rich accounting software that aligns with your business needs can enhance efficiency and provide valuable insights into your financial health.

12. Summary & Conclusion: Making the Right Choice for Your Business

When running a business, selecting the right accounting software is a decision that can significantly influence your financial management and overall business efficiency. Throughout this article, we have explored the various facets of QuickBooks and Xero, two of the leading names in the accounting software industry. By examining their pricing, ease of use, feature sets, integration capabilities, mobile accessibility, customer support, scalability, security, and user feedback, we aimed to provide you with a comprehensive understanding to make an informed choice.

QuickBooks, with its long-standing reputation and extensive feature set, offers a robust solution that caters to businesses of all sizes. Its advanced invoicing, comprehensive payroll services, and strong inventory management make it a powerful tool for those seeking a detailed and extensive accounting platform. The user-friendly interface and extensive customer support resources further enhance its appeal, especially for those new to accounting software.

On the other hand, Xero shines with its modern, cloud-based approach and strong focus on real-time data access. Its seamless bank reconciliation, multi-currency support, and integration with over 800 third-party apps provide a flexible and scalable solution for businesses looking to streamline their financial processes. Xero’s emphasis on automation and ease of use makes it particularly attractive for businesses that prioritise efficiency and simplicity.

Ultimately, the choice between QuickBooks and Xero should be guided by your specific business needs and operational style. Consider the features that are most critical to your business, the scalability required as you grow, and the level of support you need. Both platforms offer trial versions, allowing you to explore their functionalities firsthand and determine which feels more intuitive and aligned with your business processes.

As you contemplate this important decision, remember that the right accounting software is more than just a tool—it’s a strategic asset that can drive efficiency, accuracy, and growth. Investing the time to choose the right platform will pay dividends in the long run, ensuring that your financial management is streamlined and effective.

We invite you to return to KrisLai.com for more insightful articles and resources that will help you elevate your business acumen and improve your leadership skills. Whether you are looking to enhance your financial management, develop strategic insights, or learn new leadership techniques, our blog is dedicated to providing the knowledge and inspiration you need to succeed. Stay informed, stay inspired, and continue to strive for excellence in your business endeavours.

Take the next step in transforming your business today. Explore the trial versions of QuickBooks and Xero, and see firsthand how these platforms can enhance your financial management. Share your experiences with us in the comments below, and let’s continue the conversation on how to elevate your business to new heights. Don’t forget to subscribe to our newsletter for the latest tips, strategies, and insights to keep you ahead in the world of business. Your journey to business excellence starts here at KrisLai.com.

- Turn AI Anxiety into Competitive Advantage: How to Future-Proof Your Workforce for the AI Revolution

- Unlock Profit: Calculate Customer Lifetime Value & Maximize Growth

- Creating a Customer Persona: A Step-by-Step Guide On How To Do It

- Unleashing the Power of Digital Signage: The Best Software to Transform Your Business

- How Businesses Can Use Freelance Platforms & Expert Networks to Scale Smarter